.

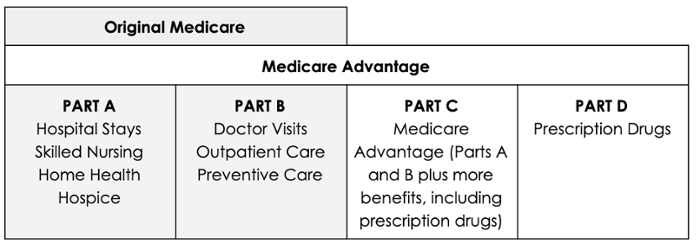

ORIGINAL MEDICARE VS MEDICARE ADVANTAGE

With so many Medicare coverage options out there, it can be hard to know which plan is right for you. To help make your decision a little easier, we’ve created a quick guide about the differences between Original Medicare and Medicare Advantage.

*Please note: This information is intended to be educational. University of Utah Health Plans does not offer Medicare or Medicare Advantage Plans. U of U Health Plans currently offers Medicaid, CHIP, individual and family, and employer groups plans.

ORIGINAL MEDICARE BASICS

Original Medicare is a health insurance plan funded by the federal government. It helps pay for hospital fees (Part A) and outpatient visits with your doctor (Part B). There are lots of components to Original Medicare, so let’s break it down:

Eligibility and Enrollment

You become eligible for Original Medicare when you turn 65, but you may not be automatically enrolled in the plan. The steps you need to take for enrollment are different depending on your unique situation:

| I’m turning 65 within the next three months but am NOT yet getting benefits from Social Security or the Railroad Retirement Board (RRB). |

|

|---|---|

| I’m turning 65 within the next three months and I am getting benefits from Social Security or RRB. |

|

| I plan to continue working when I turn 65. |

|

Parts A and B

Original Medicare covers only Parts A and B—you’ll learn about Parts C and D later. Part A is your hospital and inpatient care insurance, and Part B is your insurance for all other medical needs. Here’s what they cover:

| PART A |

|

|---|---|

| PART B |

|

Medicare Parts A and B don’t cover everything. For example, coverage does not include:

- Prescription drugs

- Long-term care

- Most dental care

- Eye exams for glasses or contacts

- Dentures

- Cosmetic surgery

- Acupuncture

- Hearing aids

If you want drug coverage, you can join a separate Medicare prescription drug plan (Part D). You can also get drug coverage, extra benefits, and help paying for your out-of-pocket costs with a Medicare Advantage plan (Part C) or your employer if you are still working. If you don’t know whether your Original Medicare plan will cover your test, medical supplies, or service, you can check by typing it in the search bar at medicare.gov/coverage.

MEDICARE ADVANTAGE BASICS

Medicare Advantage plans are a great alternative to Original Medicare because they provide the benefits of Original Medicare coverage and more. These plans are offered by insurance companies, not the federal government.

Eligibility and Enrollment

To be eligible for Medicare Advantage, you must also qualify for Medicare Parts A and B. You can look at the chart above for a refresher on eligibility. Medicare Advantage plans also have specific service areas they can provide coverage in. These service areas are licensed by the state and approved by Medicare. You must live within that service area to get a Medicare Advantage plan.

You can search online for plans near you or call Medicare at 1-800-633-4227 for help. If you currently have insurance with your employer or individual/family insurance through the Marketplace (Obamacare), you may be able to keep your same insurance provider and move to their Medicare Advantage plan if they have one.

Parts C and D

Part C is also called Medicare Advantage. These plans cover everything Original Medicare covers through Parts A and B and may include routine dental, hearing, and vision benefits. These plans are also very affordable—many of them have $0 monthly premium payments. It’s important to remember that you must pay a monthly premium for Part B coverage to have a Medicare Advantage plan. Part D is prescription drug coverage. It can be purchased as a standalone plan or part of a Medicare Advantage Plan. Many Medicare Advantage plans are all-in-one plans, which include hospital, medical, and drug coverage.

Here’s a brief overview of how Original Medicare and Medicare Advantage differ:

CHOOSING BETWEEN ORIGINAL MEDICARE AND MEDICARE ADVANTAGE

Now that you understand the basics of each type of plan, you’ll also want to consider other factors when making your choice:

Which doctor(s) you want to go to

With Original Medicare, you can visit any doctor in the United States that accepts Medicare. With Medicare Advantage, however, you are limited to the providers in your specific network. Most insurance plans have a website where you can check if your doctors are in-network. You can also call the insurance company or your doctor.

Your budget

When deciding what options best fit your budget, ask yourself how much you spent on health care last year. Keep this number in mind while reviewing your different plan options. For example, Original Medicare plans do not have an out-of-pocket maximum, but Medicare Advantage plans do. If you need a lot of health care services, A Medicare Advantage plan might help you reduce your overall costs by setting a limit on how much you will pay out of your own pocket in a single year.

How often you travel

Because Medicare Advantage plans have a network of providers within a certain geographical area, you may be limited in your health care options. If you travel frequently or stay in another place long-term (like visiting your grandkids for the summer) and need ongoing care, make sure you can find a provider in-network. Or, make sure you have room in your budget to pay for out-of-network health care services. Many Medicare Advantage plans will cover emergency services while traveling, but not routine care.

Your long-term health care needs

If you are generally healthy and don’t need a lot of medical care, Original Medicare might be enough. But, if you have prescription drugs or want coverage for other types of care (like vision or dental), a Medicare Advantage plan might be best. The good news is that once you pick a plan, you are not stuck with it. If your situation changes, you can change your plan to better fit your needs designated open enrollment periods.

THE TAKEAWAY

There are lots of things to consider when choosing Medicare coverage. This chart summarizes the key similarities and differences between Original Medicare and Medicare Advantage.

| ORIGINAL MEDICARE | MEDICARE ADVANTAGE | |

|---|---|---|

| Premiums | Yes. Depends on your income. | Sometimes. Many Medicare Advantage plans have $0 additional monthly premiums (you still have to pay a premium for Part B coverage) |

| Copays (fixed amount) | No. | Usually. Most Medicare Advantage Plans charge a copay each time you see a doctor. |

| Coinsurance (varied amount) | Yes. Original Medicare charges a 20% coinsurance for the service you received—after you have met your deductible. | Sometimes. Medicare Advantage plans can choose how much coinsurance is for different services. |

| Out-of-Pocket Maximums (varied amount) | No. Original Medicare does not have an out-of-pocket limit. | Yes. Your Medicare Advantage plan will pay the full cost of your care after you reach the limit. |

| Deductibles (annual, accumulated amount) | Yes. The current deductible for Part B coverage in 2021 is $203. | Sometimes. Medicare Advantage plans may or may not have a yearly deductible. This varies per plan. |

| Provider Network | Broad. You can see any provider throughout the U.S. that accepts Medicare. | Narrow. You have a specific selection of providers to choose from. You will pay more for out-of-network services. |

| Vision | No. You can still get eye care for medical conditions, but Original Medicare does not cover eye exams for glasses or contacts. | Usually. Many Medicare Advantage plans offer additional benefits like vision care. |

| Dental | No. | Usually. Many Medicare Advantage plans offer additional benefits for dental care. |

| Hearing | No. | Usually. Many Medicare Advantage plans offer additional benefits for hearing-related services. |

| Drug | No. But you can buy a separate Part D Medicare drug plan. | Yes. It is rare for a Medicare Advantage plan to not include drug coverage. |

| Supplemental Insurance | Yes. You can have dual coverage with Original Medicare and other coverage, such as TRICARE, Medigap, veteran’s benefits, employer plans, Medicaid, etc. | Limited. You cannot have Medigap and Medicare Advantage. But you can have other dual coverage with Medicaid or Special Needs Plans (SNPs) |